Why is council tax proposed to increase?

Council tax contributions for Dorset Council are proposed to increase by just under 4% to help fund the rising cost of adult social care and children’s services, protecting the most vulnerable people in society. Councillors will vote on this proposal at the Full Council meeting on 18 February.

The proposed increase would also protect so called ‘discretionary’ services which are services a council can choose to provide but does not have to, such as country parks, weed clearing and school crossing patrols. Dorset councillors are keen to avoid any cuts to services for residents.

Why do social care services need more funding? Growing demand…

Social care provides essential care and assistance for children and young people at risk of harm, people with disabilities and older people who need extra support.

Dorset Council is legally required to provide social care, and these services are often expensive to provide. Well over half of Dorset Council’s total budget is spent on adults’ and children’s social care.

Demand for both adults’ and children’s care has been rising rapidly over recent years and this growth is forecast to continue into the foreseeable future. As our population ages, people are living longer with increasingly complex health conditions. We’re also caring for and supporting more children with special educational needs and disabilities (SEND).

Why can’t the council fund social care without increasing council tax?

Since 2010, central government grants to councils have been cut by nearly 60%. We no longer receive any Revenue Support Grant from central Government. Instead, the Government expects us to raise the funding we need through council tax. This is why 2% of the increase in council tax is what is known as a ‘social care precept’ – in other words, central Government is encouraging councils to increase council tax specifically in order to fund the growing cost of social care.

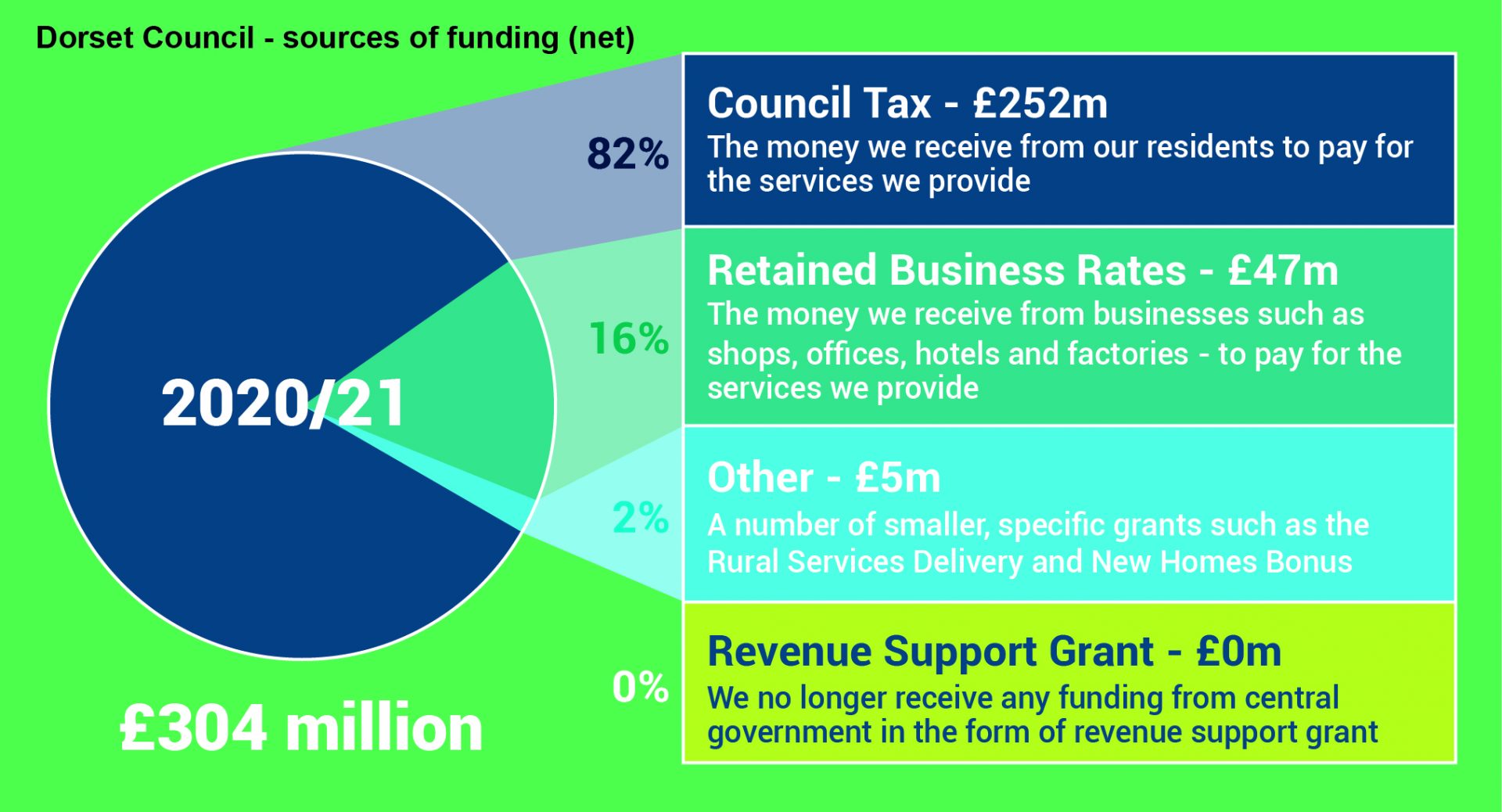

As you can see from this chart showing our sources of funding, Dorset Council is very dependent on council tax for income. Unlike some other councils, we get relatively low income from business rates and other sources.

Efficiencies, not cuts

Since the reorganisation of local government and the creation of Dorset Council on 1 April 2019, we have already achieved cost reductions of around £17m. Here are some examples:

- A reduction in the number of senior officer roles, and removal of duplication across support services like finance, HR and IT

- A reduction in the number of councillors from 204 to 82

- Cost reductions have been made on insurance, audit fees, banking and other activities where the council only has to pay for one organisation rather than six.

Next year, we plan to make further multi-million pound savings by:

- reducing the number of properties and land the council owns

- reducing travel and transport costs

- procuring services and products for the council more efficiently

- and changing the way we provide services so it’s a better experience for residents but delivered at lower cost.

All savings are reinvested into essential services for residents such as social care, highways and waste collection.

Our councillors are also lobbying Government for fairer funding for Dorset, particularly for special educational needs and disabilities and social care.

Protecting services

Our aim is to get the council working more efficiently, reducing the cost of overheads, and ensuring more of the council’s resources go into services for residents.

Cllr Spencer Flower, Leader of Dorset Council, said: “We would of course prefer not to raise council tax. However, we are left with no choice due to a steady decline over recent years in the overall funding from central government and the rising cost of adult social care and children’s services. The alternative would be to cut discretionary services such as country parks, weed clearing and school crossing patrols which neither I nor my colleagues wish to do.

“As an advocate for Dorset, over recent months I have lobbied Government for fairer funding – particularly for Special Educational Needs and Disabilities (SEND) and social care. As a result, we did secure a much needed additional £10m funding from Government in the autumn spending review. I will continue to make the case for Dorset with Government throughout the coming year.

“We have a statutory obligation to deliver many of our services. And looking after our most vulnerable residents is very important to us. And it is also important that we achieve a balanced budget through efficiency, not cuts.”

Yet again we have been lied too. We were told that by having a unitary authority this would achieve savings. This has not happened, first year North Dorset took the greatest hit by having to bring us up to other areas and now we are told 4% increase this year. No savings, no truth.

HI Michael

The council has – and continues to – make many savings. Those cost reductions are listed above, to the tune of £17m. Only by creating this unitary authority were we able to make that saving. We have planned for further millions of pounds worth of savings through the efforts listed above.

Thanks

Alex

This is just an increase in council tax, on top we have the police, fire service and parish council inverses as well, where do you think people like me on a limited income and just on the threshold of not being able to find money to pay, on top of this we now have to pay for our television license, where is it all going to end, I’m glad on my way out.

What are the “other services” that cost £35.6 million pounds?

Hi Mike – it’s on the image:revenues and benefits, finance, procurement, pensions, HR, IT, Legal and democratic services.

Thanks,

Alex

in the public interest you should publish a full breakdown of the £35.6 million, as it seems the largest amount is very vague, when you have gone into detail the smaller amounts.

HI Marie – we have, please see the * at the bottom of the image, thanks. Alex.

On your chart you have *£35.6m

*includes Revenue& Benefits, Finance, Procurement, Pensions, Human resources, IT, Legal and Democratic Services.

Why is there not a breakdown of these items?

I for one would like to know where this money is being spent.

This increase is 3 times the December 2019 declared CPI.

If income tax were increased at this rate the general public would be hugely resistive.

Council tax is just that – further tax, paid for out of Income tax paid salary.

Arbitrary increases of this level are unjustifiable.

Alex, you say you have outlined the use of £35.6m * at the bottom of the image. That is not clear enough as the coujcil also include, over the page, grants such as Rural Services Delivery and New Homes Bonus. Could Dorset Council please provide the exact breakdown of the ‘other services’ as this portion is clearly the largest home oweners have to pay. s

Can you specify what comes under the heading of “commissioning and partnerships “. This figure at £8.8 m is almost the same as “education ” – not insubstantial and therefore needs to be explained in detail

A very disappointing increase. I do not believe the £17m saving is that much. Does this include the proceed of sales of now empty council property or is this being squandered elsewhere. Has the council closed expensive final salary pension schemes and better than private sector benefits for its employees? If a member of the public or business has a shortage ie costs are higher than budget then they would have to manage and make savings so the council should do the same. It is easy to suggest cuts for areas that would visibly affect people as suggested ie weed cutting/parks but I expect if councils were a private concern there would be other internal operating savings. 4% is too high.

Hi Phil, thank you for your message.

We are undergoing a property asset review but I don’t believe any decisions have been made over selling empty council properties, as you put it. Managing our budget and making savings is what we are constantly working on. We have used a variety of tools to predict what demand may fall on our services over the short and longer term. This includes analysing huge amounts of data, known and forecast volume and price inflations, working other councils, financial modelling based on possible economic, social and environmental changes… and much more!

thanks

Alex

When will the exact percentage be notified?

Is it going to be 3.99% or 3.999%? Why not make it 4% and be done with it.

Hi Michael. The exact figure of the general council tax is 1.995%; to levy 2% as the social care

precept. So, 3.995% in total, rounded up to 4% for ease of reading.

Thanks

Alex

A further increase yet again in council tax! I see NO improvement in clearing of rubbish along roads, which I have bitterly complained about for years to councillors. When will you really tackle litter louts HEAD ON ? We need spot checks with CCTV proof, fines, warning signs, shaming in local papers. Where is your willpower to end this unsightly and disgusting scourge on our countryside?

Barry,

the answer is do it ourselves. We live on a cut through route and every weekend the remnant packaging of entire McDonalds and KFC meals is tossed out of vehicles without a thought. Every morning I walk my dog and pick up more rubbish, it saddens me to think that this rubbish ends up in the watercourses and ultimately our food chain via marine pollution. The Council will facilitate self-help but we still need Council to lead a PR campaign and more proactive enforcement. I read that McDonalds was going to write the vehicle reg on Drive thru orders which could be a start.

when the merger between various councils was proposed you said it would SAVE money.Clearly not true.Instead you are increasing rates by almost twice the rate of inflation.Clearly you cannot be trusted.So please think again

Hi Jo, thanks for taking the time to comment. The reorganisation of councils in Dorset has brought six council workforces into one. This piece of work removes duplicate roles and reviews service structures and is forecast to provide an additional £17.2m in this financial year alone. We are working hard on an ambitious internal transformation programme that will continue to deliver service efficiency, not service cuts. We aim to realise over £14m in service efficiencies in 2020/21.

All savings from LGR are being reinvested in to front line services – those services that are demand-led from our communities.

Thanks

Alex.

Why, in the opinion of our council and councillors, is the number of children with special needs increasing yèar by year. Money needs to be spent on the cause of the problem instead of the result.

Ll

once again we get promises as to the future with “next year, we plan to make further multi-million pound savings” if they have been identified, why have they not been done. Why are you salami slicing as opposed to the major surgery that we all expected and want?

There is so much in your vague list of heading, that should just go.

With this increase plus the police tax etc I do not have much left from my pension.

Hi Tony, thanks for your comments. We have only been an established council for less than a year, remember. The reorganisation of councils in Dorset has brought six council workforces into one. This piece of work removes duplicate roles and reviews service structures and is forecast to provide an additional £17.2m in this financial year alone.

We are working hard on an ambitious internal transformation programme that will continue to deliver service efficiency, not service cuts. We aim to realise over £14m in service efficiencies in 2020/21.

Thanks

Alex

Like Michael Hopper I feel that in particular North Dorset residents are being subjected to an unsustainable increase in council tax. We now have one of the highest rates of council tax in the country and have gained nothing from the formation of the new unitary council. Council tax for an average band D property now equates to more than a quarter of the annual average state pension for those who retired prior to 2016 and is having a major impact on peoples ability to keep their heads above water. I note that the council charges for weed clearing as part of the discretionary items but in Gillingham most if not all of this as well as litter picking is carried out by volunteers so why are we being charged for this and what services are covered by” other services” with a massive bill of £35.6m? Surely some of the £17m savings from last year could be used to reduce the charge on residents and reduce the impact of unaffordable increases. Noted that the council has lobbied for fairer funding but it is a an undeniable fact that the the reduction in central government funding for councils is a direct result of Conservative MPs voting consistently for swinging cuts in this funding and the council by nature of being Conservative led is complicit in the very thing which you are complaining about and had you been vocal enough at the time prevented.

Hi Bernard,

Thanks for your comments.

Everyone in the Dorset Council area has equal access to council services. Spending money on specific projects is for councillors to decide. If you have a specific request, please contact your local councillor here: https://moderngov.dorsetcouncil.gov.uk/mgMemberIndex.aspx?bcr=1

Various projects may be ‘ring-fenced’ to a certain location. For example, a hosing development in a particular town would provide S106 funding for local community facilities in that town.

In regards to “other services” these are: revenues and benefits, finance, procurement, pensions, HR, IT, Legal and democratic services.

Thanks

Alex

You clearly have no idea or care what the effect of these increases is having on low wage areas like North Dorset where many people are above the threshold for relief on charges like council tax but ultimately struggle with the daily costs of living. Your reply does not answer or justify the use of the £17M savings, some of which should have been used to reduce the council tax increases.

Bernard, you have been levelled up!

Prior to the Unitary Authority merger, Weymouth and Portland Borough Council was the highest Council Tax in the country, if memory serves. Remember all those merger options at the time, the decision was made to slow down (not stop) the Council Tax increases for the most expensive areas (W&PBC) and use fiscal drag to bring up the cheaper areas over time to the same level – and then look out! I wrote to Sajid Javid at the time (remember he said he was minded to approve the merger) urging him not to support the Unitary split that grouped the wealthiest Boroughs (Bournemouth Poole and Christchurch) together. Blessed(?) with the bulk of Dorset’s 750k residents, over a relatively small geographical area, Services can be delivered more efficiently AND defrayed over a larger tax base. My point to him was that the costs of providing Services over the rural rump of Dorset, over a smaller tax base (further exacerbated because a lot of vulnerable households receive Council Tax Benefit (100% waiver)) would be dis-proportionate and ultimately unsustainable over the medium term – and guess what happened. Council Tax has doubled in the last 20 years and is well on the way to doubling again over the next 20 years (including the weasel worded precepts). You could not devise of a more effective way of emptying the County of working families. And the answer is not concreting over every inch of greenery, if we do this the tourists will not come.

The amount of over £170M spent on adult and children’s care is truly staggering when so little is spent on all the other essential services. Any cost saving efficiencies will hardly make a dent in the ever increasing annual budget. It would not be unreasonable to wonder how long the residents of Dorset can or will be willing to meet the seemingly uncontrolled and above interest rate spending of money collected by council tax. I urge all concerned to think long and hard.

Seeing “other services “ are the third biggest expense listed I would have thought something of a breakdown was not unreasonable to expect. 35.6m is rather a large sum to simply pass off.

Hi David,

Not sure what you mean – we have listed out where this money goes – revenues and benefits, finance, procurement, pensions, HR, IT, Legal and democratic services?

Thanks,

Alex

How much of the £35.6m is allocated to each of those ‘other services’?

David is absolutely correct. To blandly state that £35M is spent on the above “other services” is not satisfactory and this amount of money should be subject to proper public scrutiny.

If you have made so many savings why the big increase ?

Also why don’t you increase the transport budget to cover more routes like Ferndown to Christchurch ?

You state reducing travel and transport costs surely if that is public transport that is against government recommendations ?

As to child social care this should stay as it is not be increased

Hi Sally. Thanks for your comments.

The challenge with the demand-led adults and children’s services is the high number of unknowns that make budgeting for these areas extremely difficult. This includes families moving in to the area that may have their challenges, the demographic of the area, costs of goods and other services, gaps in areas such as foster carers etc…

Our medium term financial plan includes £10m of additional funding for Children’s Services and £11m for adults services. This is a total of £21m invested in to frontline services. We are experiencing pressures from both of these services. In particular, we are experiencing significant underfunding of the Special Educational Needs and Disabilities (SEND) provision by Government.

We have also inherited a cumulative Direct Schools Grant (DSG) deficit of around £16m from Dorset County Council and if this year’s expected deficit is added to that, the deficit is likely to be well in excess of £20m. Councils nationally have consistently campaigned to have these overspends addressed by the Treasury. The details on how this will be paid are still be decided. The decision for that lies with Central Government.

The current and projected financial situation is clearly unsustainable. More importantly, the funding needed going forward for the demand-led social care and SEND services cannot be achieved through the reductions in what are already very tight discretionary service budgets.

Our members are clear that we won’t penny pinch for the neediest in our community, so investment in to child social care must be increased.

Thanks

Alex

It is encouraging that the council leader has secured 10m funding from central government and that the council by reorganisation has saved 17m. It is to be hoped that there can be further successful negotiation this coming year. We in rural communities are in the position of being relatively sparsely populated with fewer council tax payers covering the expense of the service land area. The government should be paying more in revenue support to rural counties.

Hi Julian. Thanks for your comments. Our councillors and officers continue to fly the Dorset flag – so to speak! – in the halls of Central Government for fairer funding across our services, particularly for Special Educational Needs and Disabilities (SEND) and social care.

Thanks

Alex

Dorset has a high percentage of elderly and vulnerable residents, markedly more so than many other areas. The Social Care precept should be a flat rate across the country – centrally pooled and then re-distributed by Central Government. Councillor Spencer Flower should not be giving in and pushing this burden down to the dwindling number of working families in Dorset, you should be telling Central Government to do one – and if they refuse to listen make the argument more forcefully – how about a national e-petition?? It is blatantly dishonest to to tell us that a local referendum is required to breach a 3% rise in Council tax, when cumulatively higher rises are floated through as precepts.

And by the way the Police pre-cept should be a flat rate too, it is morally unacceptable to expect some to pay more for policing based on their Council Tax band when it is a safety critical service equally available to all. I advocate flat rates for both locally with shortfalls made up centrally as the fairest way to distribute general taxation.