Council tax bills are being sent out from this week. This article aims to explain Dorset Council’s budget and the reasons for the council tax increase.

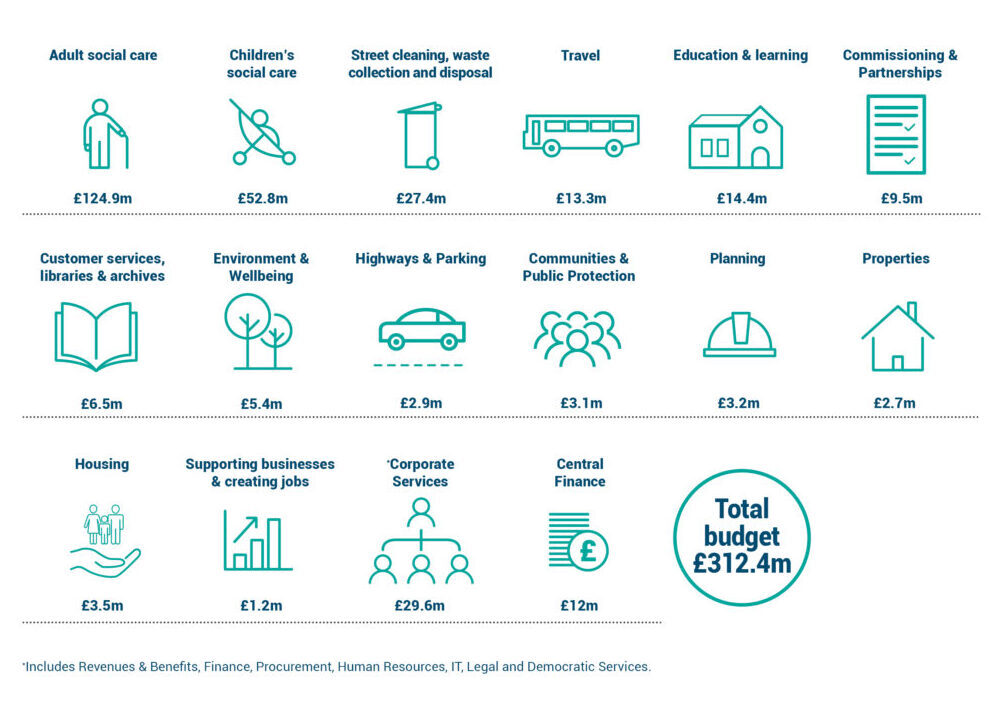

The council has increased its budget for next financial year to £313 million (from £304 million last year). The annual budget pays for all the services the council provides to residents, communities and businesses.

Impact of COVID-19

2020-21 was particularly challenging. Like most councils across the country, we faced significant financial pressure due to extra expenditure related to the COVID-19 pandemic. This included support for vulnerable residents through a range of services such as adult social care, housing and mental health.

We also incurred extra expenditure on PPE and COVID-secure arrangements, and saw a reduction in income from our car parks, leisure services, business rates and council tax.

The financial impact of the pandemic continues. For example, when people who have been seriously ill due to COVID are discharged from hospital they often require support from the council with adaptations to their home, occupational therapy, and adult social care.

Although the Government provided some funding for the additional costs and loss of income it was not enough to cover it in full.

Looking after our residents

The demand for our services was already rising before the pandemic, with people living longer with complex health needs. Dorset has significantly more older people than many other areas of the country: 29% are aged over 65 compared to 18% in England and 12% in London.

Although council tax pays for many services, including waste collection and road maintenance, over half of the council’s spending goes on social care. This supports vulnerable children at risk of neglect or abuse, disabled children and adults, and older people with significant, complex care needs.

Every year, Dorset also sees growing numbers of children diagnosed with special educational needs and disabilities (SEND).

The council has a legal duty to provide those vital services: we can’t turn away people in need because we can’t afford it.

Balancing the budget

Overall, despite considerable additional funding from government, the council is significantly overspent at the end of the financial year 2020-21. We have covered the increase in expenditure from our reserves. However, reserves are like building society savings; we can only spend them once and doing so reduces our capacity to respond to further unexpected events in future.

Councillors have considered whether we could reduce our expenditure by cutting some or all of our discretionary services. Councillors want to continue providing these important services, but we are looking at ways to deliver them differently, at a lower cost.

Government funding to councils across the country has fallen by 60% since 2010. And here in Dorset we no longer receive a Revenue Support Grant (RSG) from Government, although some other councils still do. We also get less income from business rates than councils in more urban areas.

This means that funding for essential local services in Dorset falls more heavily on the shoulders of council taxpayers than in many other counties. We continue to lobby Government for a fairer funding deal.

Councillors faced stark choices when setting the budget, and so a total increase of just under 5% in council tax was recommended to safeguard services.

How the budget is being funded:

- Council tax increase – increasing council tax by just under 5%* (just under 2% increase in general council tax, and just under 3% to fund adult social care – known as the ‘adult social care precept’). This will generate an additional £12 million

- Pay freeze for staff - 0% pay award for staff. For illustration, a 1% cost of living increase would have cost £1 million

- Further efficiencies and savings, while protecting essential services. This will save £27.7 million

*This equates to the rate for a Band D property increasing from £1,694.79 to £1,779.39 – an increase of £84.60 for the year, or £1.62 per week.

We are also working to make better use of our property and assets. This includes selling some buildings which are no longer needed. The income generated through sales will bring in Capital Receipts, which are one-off pots of money that can be invested in new building projects and reduce borrowing costs, but cannot be used to fund the day-to-day running of services.

Financial support

If you have faced redundancy or other financial hardship as a result of the pandemic and are struggling to pay your bills, you may be eligible for Council Tax Support – find out more, including how to apply.

We also fund Dorset Citizens Advice to provide support and advice to residents who are experiencing financial difficulties or are feeling stressed or worried. Call freephone 0800 144 8848.

Cllr Gary Suttle, Portfolio Holder for Finance, Commercial and Capital Strategy, said:

“It has been particularly challenging developing the budget for next financial year, 2021-22, due to the high level of uncertainty caused by the COVID pandemic. COVID has had a massive impact on our communities and our budget this year and this is likely to continue over the coming months.

“We developed proposals that will deliver a balanced budget, but it has not been easy and it is with a heavy heart that we have had to increase council tax increase. We understand that many residents and local businesses have been hit financially by the pandemic, and there will be support available for the hardest hit. The budget assumption of a pay freeze for staff is also made with a heavy heart when we are keenly aware how hard staff have worked for many months.

“These are tough choices, but we have to find ways to fund the support for communities through the pandemic and the ever-growing need among our residents for social care services. We continue to lobby the Government for further funding and we will endeavour to protect the vital council services on which so many residents rely.”

Covid our not it would have gone up anyway when are we going to see a reduction that’s a laugh.

Even though we understand all the reason’s behind the rise in Council Tax, our area has one of the highest Council tax in the country, people working here have some of the lowest paid job’s, and they & the many retired people only have so much money, its to easy to keep putting tax up & many people are finding it very hard.

We do not need a police commissioner and at 6% increase in their cost and with inflation running at 1% ish that is disgraceful. If the money was used for care etc that would have been more acceptable, especially when there are growing towns like Verwood with no manned police station. We should have a vote on not who the commissioner is but if we want one.

I’d be interested to know why you list council tax as one of the areas where receipts have gone down? Also, what has happened to the reduced costs supposedly resulting from the reduction from 9 councils (District, etc) to two unitary ones?

We live in one of the highest council tax areas in the UK, in fact dorset is the second highest, how is this justifiable?? I am going to be surviving on a small pension and my pathetic government pension that one gets at 66 years of age, I have been told I am not able to apply for a rebate, other than the 25% single person allowance with the presumption being that I am one and a half people I am presuming. Corfe Mullen council has put a 20% precept on our council tax and you have put our council tax up by 2%. While you may feel this is very affordable, I do not. This is 20% of my OAP pension. What do you suppose my life will be like after my council tax has been taken out of my bank account. I am thinking of withholding my DD for council tax.

It would save the readers’ time if you included a tabular summary of the changes in the main spending areas, e.g.

Staff wages………………………..Increase 0%

Road Works………………………..Decrease 4%

Parks and Gardens………………Decrease 2%

Social services…………………….Increase 1%

These are the key things the public (ie Your Employers) want to know. They don’t want to wade through volumes of text to get at the meat.

“ This equates to the rate for a Band D property increasing from £1,694.79 to £1,779.39 – an increase of £84.60 for the year, or £1.62 per week. “

So why am I having to pay £2300 council tax for my band D property in Weymouth?

It certainly doesn’t pay to save all your life, buy your own home only to be hit with high council tax bills as a pensioner. My advice to my children and grandchildren will be to spend their money, don’t invest in property. We’re constantly paying tax on money that’s already been taxed. As pensioners we shouldn’t be penalised. When in comes to social care in later years guess who will have to pay! Once again, penalised for saving and buying your own property.

Can you please advise what the money used for the following is in detail:-

Commissioning & Partnerships £9.5 M

Corporate Services £29.6M

Central Finance £12M

There is a lot being blamed on COVID-19 so if don’t have this expense next year and we hold out with that argument it will mean CT will have to be reduced next year. Anyone want to put a wager on that?

it is a disgrace to increase council tax by over twice the rate of inflation.we have zero confidence in the council again

I was shocked when we received our bill. Honestly this is not reasonable at all, we are being penalised by a Council who has become unitary and obviously cannot afford to be? This is unethical. We cannot afford the extra amount each month as have been affected by the pandemic and have less earnings. Surely we should have a council tax increase break this year? Why push the debt onto the residents of the county?

Surely there could be another way for the Council to pay for services, most of which do not benefit us in the rural villages to be honest.

I am very disheartened by all the changes in the local council and the way that the bill is passed onto the local communities.

And for it to be such a high increase compared to previous years too is unreasonable. I have read the explanations but I still believe we are being penalised. This has to change.

I do not know how we will afford the extra amount on low incomes and working hard to pay high rents and high electric heating bills in a stone cottage.

Also wondering if this huge increase will mean that beaches and public green spaces will be patrolled more in the warmer months to avoid mass dumping of litter like we saw last year?

Why not up the penalties on that kind of activity rather than putting higher bills on the residents?

I am completely at a loss as to how to deal with this right now. Hoping for some windfall.

Hi hilscampbell

We do understand that the past year has been a challenging time financially for some of our residents. Many other wealthier councils continue to receive Revenue Support Grant (RSG) from Government, but Dorset Council no longer does. We also get less income from business rates than councils in more urban areas.

This leaves us no choice but to rely heavily on council tax to fund local services. Council tax makes up 85% of our income, and central Government expects councils to raise the extra income they need through council tax, rather than through central funding from income tax.

If you have faced redundancy or other financial hardship as a result of the pandemic and are struggling to pay your bills, you may be eligible for Council Tax Support – visit our website for details on how to apply, search for ‘Council Tax Support’.

We also fund Dorset Citizens Advice to provide support and advice to residents who are experiencing financial difficulties or are feeling stressed or worried. Call freephone 0800 144 8848.

I hope this helps, Kirstie

2020-21 was particularly challenging. Like most councils across the country, we faced significant financial pressure due to extra expenditure related to the COVID-19 pandemic. This included support for vulnerable residents through a range of services such as adult social care, housing and mental health.

The council’s strategy is focused on generating funding from residents, with only 1.2M spent on business and job creation. You need to re-think your approach to establish more creative and sustainable revenue streams. Start using the assets we have to get a return on our investment.